We are a prominent full-service asset manager with $360 billion of AUM and $62 billion of AUA. We serve both individual and

institutional customers, offering them domestic and international fixed

income, equity, multi-asset and alternative investment products and solutions

across a range of geographies, investment styles and capitalization spectrums.

We are committed to investing responsibly and delivering research-driven,

risk-adjusted, client-oriented investment strategies and solutions and

advisory services.

4Q’25 Investment Management Adjusted Operating Earnings before Income Taxes, TTM of $226mm

-

Note: Pre-tax. Excludes Adjusted Operating Earnings attributable to

Corporate. Adjusted Operating Earnings is a non-GAAP financial measure.

Information regarding this non-GAAP financial measure, and a

reconciliation to most comparable U.S. GAAP measure, is provided in the

“Reconciliations” section of the Quarterly Investor Supplement.

Performance dashboard:

Distribution:

-

Institutional: Through a dedicated sales and service platform consisting

of direct-and consultant-focused sales professionals.

-

Retail: Through intermediary-focused distribution platform, consisting of

business development and wholesale forces which partner with: banks,

broker-dealers, independent financial advisers, and affiliate and

third-party retirement platforms.

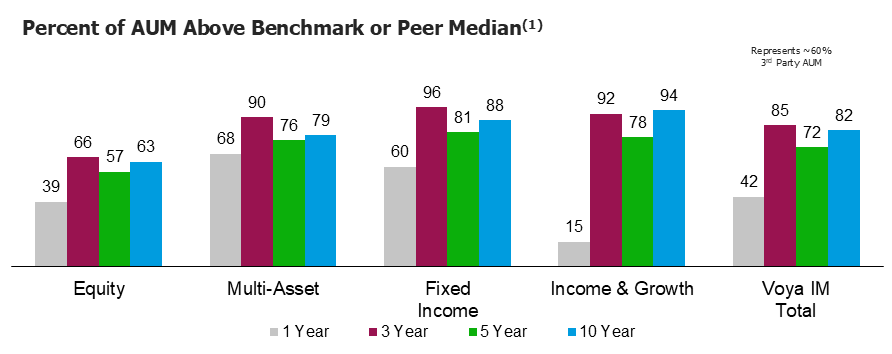

Long-term performance remains strong, particularly across 3-, 5- and 10-year horizons

-

Voya Investment Management calculations as of December 31, 2025. Metrics are inclusive of all discretionary, actively-managed, individual and pooled investment mandates managed to total return within our external client book-of-business. The results are based on pre-determined criteria to measure each individual investment product based on its ability to either A) rank above the median of its peer category; or B) outperform its benchmark index on a gross-of-fees basis. Peer rankings for open-ended mutual funds are sourced from Morningstar and based on the net-of-fee return of each individual share class, while those of institutional track records are from eVestment and based on gross-of-fee returns for the composite. Certain funds and products were excluded from the above analysis due to limited benchmark or peer group data. Further detailed information regarding these calculations is available upon request. No person should make a decision to invest in a Voya product based on these metrics. Past performance is not a guarantee or reliable indicator of future results. All investments involve risk including the possible loss of capital.