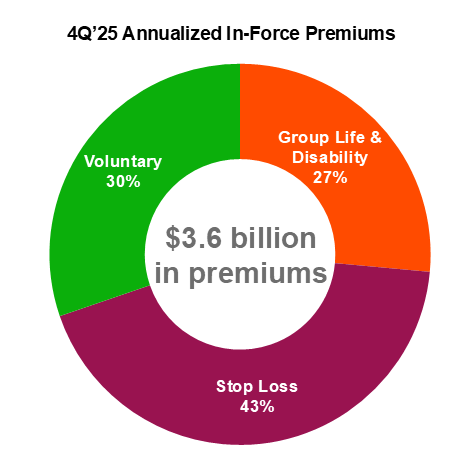

We are a Top 10 provider of medical stop loss coverage in the United States on

in-force premiums.

Our Employee Benefits segment provides group insurance products to mid-size

and large corporate employers and professional associations. In addition, our

Employee Benefits segment serves the voluntary worksite market by providing

individual and payroll-deduction products to employees of our clients. Our

Employee Benefits segment is among the largest writers of medical stop loss

coverage.

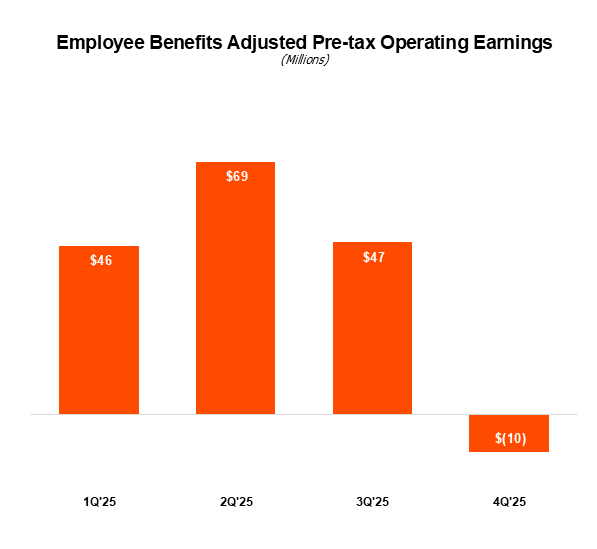

4Q’25 Employee Benefits Adjusted Operating Earnings before Income Taxes, TTM of $152mm

1. Note: Pre-tax. Excludes Adjusted Operating Earnings attributable to

Corporate. Adjusted Operating Earnings is a non-GAAP financial measure.

Information regarding this non-GAAP financial measure, and a reconciliation

to most comparable U.S. GAAP measure, is provided in the “Reconciliations”

section of the Quarterly Investor Supplement.

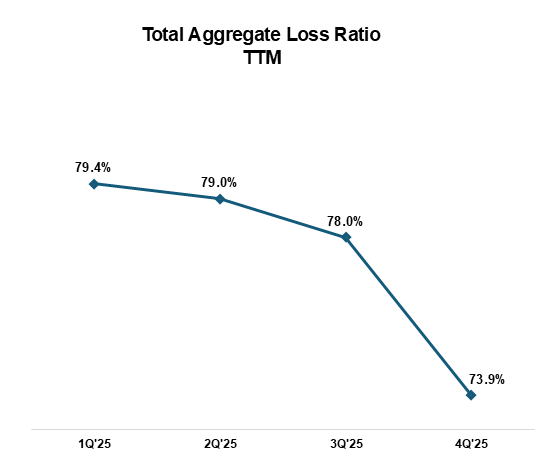

Performance dashboard:

Products: